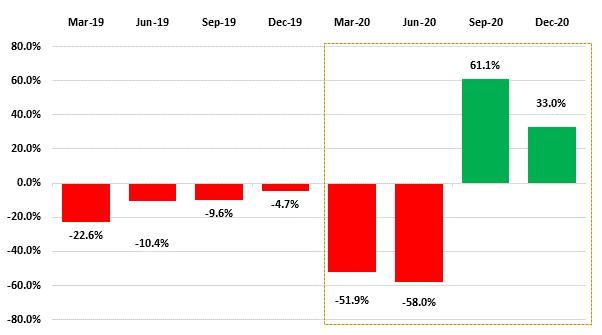

The Earnings of Colombo Stock Exchange (CSE) listed firms rose by 33% percent Year-on-Year (YoY) to Rs 88.6 billion in December quarter maintaining the growth momentum for the second straight quarter bouncing back from the COVID-19 crisis, according to a FIrst Capital Research (FCR).

The earning growth was led by the Diversified Financials (144%YoY), Food, Beverage & Tobacco (73%YoY), Capital Goods (68%YoY) Transportation (1930%), and Materials (153%) sectors.

“Strong performance in Diversified Financials, Food, Beverage & Tobacco, Capital Goods, Transportation and Materials sectors were witnessed on the back of recommencement of economic activities. BUKI earnings were up by 7005%YoY and CARS earnings spiked by 306%YoY supported by the gain from oil palm plantations, fair value gain through financial asset, and gain from currency movements,” it said.

However, the FCR observed sluggish quarterly performance on Consumer Services (-177%YoY), Banks (-19%YoY) and Real Estate (-70%YoY) sectors.

“The Tourism industry continues to be adversely influenced, hence, Consumer Services sector earnings recorded a dip of 177%YoY. The banking sector witnessed a decline of 19%YoY largely driven by SAMP (-34%YoY) and HNB (-28%YoY) impacted by the increase in impairment. Real Estate sector earnings (-70%YoY) have slowed down due to the ongoing pandemic, out of which OSEA witnessed a decline in earnings by 55%YoY,” it reasoned.