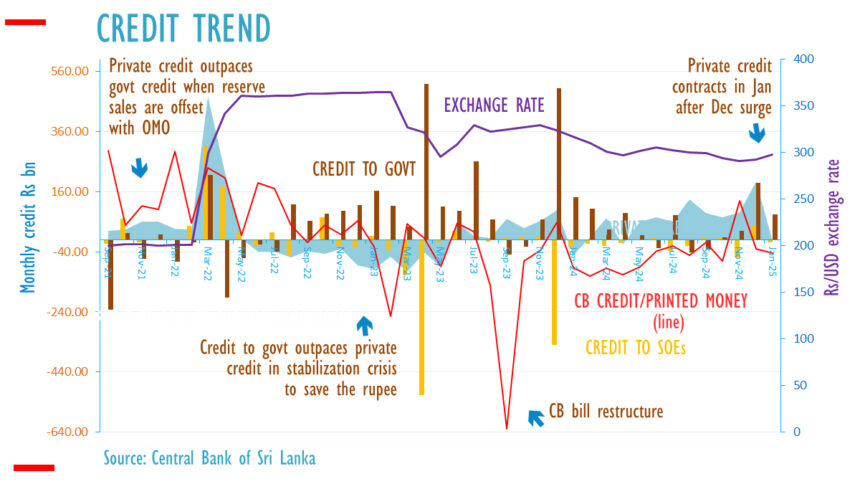

Official data revealed that while credit to the government continued to grow, private lending from commercial banks in Sri Lanka decreased by 4.6 billion rupees in January 2025 following an unprecedented spike in December.

In January 2025, the amount of outstanding private credit dropped to 8,151.4 billion rupees from 8,156.0 billion rupees in December, when private credit increased by 193.2 billion rupees due to excess liquidity.

In December, there was a significant amount of surplus liquidity in the financial system, and the rupee began to decline. Additionally, imports increased at $1.9 billion.

Up until the final quarter of 2024, when some shocks were supplied by injecting 100 billion rupees in surplus cash, Sri Lanka’s economy was robustly recovering under low inflation from a generally deflationary policy.

Currency fluctuations can be made worse by weakening currencies under the so-called “flexible exchange rate,” which can also result in changes in banks’ net open positions, increased uncertainty, and panic-driven import coverage through credit.

Credit used to pay for imports, as opposed to investment credit, may be reversed when importers sell their stocks.

Under a fixed policy rate, SOE losses had previously resulted in money printing, currency depreciation, reserve losses, and high inflation. All forms of credit are blindly accommodated with new money under a single policy rate, which causes external instability that is then blamed on “imports” or the “current account deficit” by rejecting classical economics. Credit to the government increased by 83.2 billion rupees, while credit to state enterprises decreased 8.7 billion rupees to 648 billion rupees in January 2025, after increasing 48.7 billion rupees in December.

The majority of the domestic asset-driven liquidity was taken out in January.

RELATED

Sri Lanka uses open market operations to print Rs 100 billion.

Following warnings about money printing, Sri Lanka’s foreign exchange reserves fell for three months by January 2025.

Analysis of Sri Lanka’s December 2024 private credit boom due to “abundant reserves”

Analysis of Sri Lanka’s December 2024 monthly BOP shortfall

In February 2025, Sri Lanka’s foreign exchange reserves increased somewhat.

Any expansion of credit made possible by extra liquidity has the potential to raise the price of domestic commodities, particularly non-traded ones.