Fitch Ratings has shared an optimistic outlook on Sri Lanka’s economic situation following the recent presidential election, highlighting the government’s commitment to its IMF program and debt restructuring efforts. This commitment is seen as a significant step toward stabilizing the country’s economy and fostering recovery.

Source – Fitch Ratings, Haver Analytics, Central Bank of Sri Lanka

Positive Developments

- Political Stability: The election of Anura Kumara Dissanayake from the Janatha Vimukthi Peramuna (JVP) initially raised concerns about potential disruptions to the IMF program. However, the Ministry of Finance’s announcement on October 4 confirmed that productive consultations with the IMF and the Official Credit Committee have taken place. This shows a strong commitment to maintaining the agreements made with international bondholders, which bodes well for economic stability.

- Progress in Debt Restructuring: Sri Lanka is making meaningful strides in its debt restructuring process. The government has reached important agreements with key stakeholders, including bondholders and international creditors. These agreements are crucial for restoring debt sustainability and are expected to significantly reduce debt service obligations during the IMF program period by approximately $9.5 billion.

- Economic Recovery: The Sri Lankan economy is showing encouraging signs of recovery. Real GDP growth reached 5.0% year-on-year in the first half of 2024, bouncing back from a contraction in the previous year. The government projects a growth rate of 3.9% for 2024, with an average growth of 3.6% anticipated over the next couple of years.

Financial Outlook

- Improving Debt Ratings: Fitch currently rates Sri Lanka’s Long-Term Foreign-Currency Issuer Default Rating (IDR) as ‘RD’ (Restricted Default), indicating that while the government is not servicing its foreign-currency debt, there is potential for improvement. An upgrade may be on the horizon following successful completion of commercial debt restructuring.

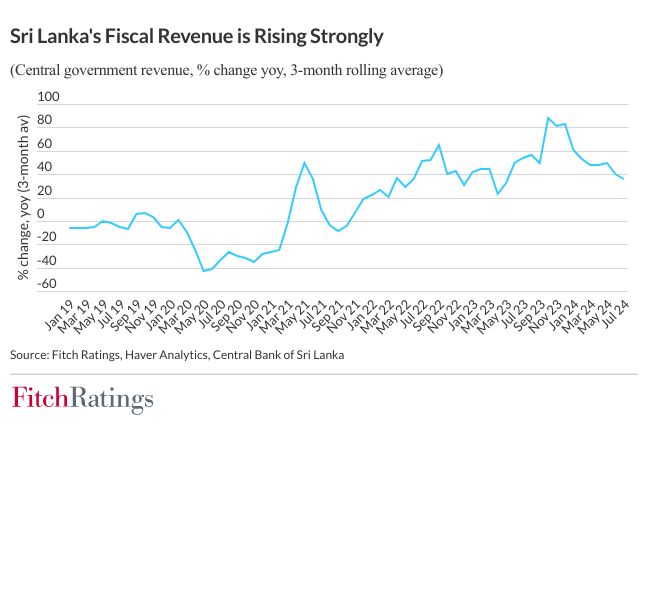

- Boosting Revenue: Although Sri Lanka’s revenue-to-GDP ratio has been low, recent revenue-raising measures implemented since May 2022 are beginning to bear fruit. Projections suggest an increase from 11.4% in 2023 to 15.5% by 2026, which would greatly enhance fiscal health and support ongoing recovery efforts.

- Strengthening Foreign Reserves: Foreign-exchange reserves have shown remarkable improvement, reaching USD 6.0 billion in August 2024—an increase of nearly 66% year-on-year. This positive trend indicates a strengthening financial position, although resuming external debt-service payments may present challenges.

Conclusion

Fitch Ratings views the Sri Lankan government’s dedication to its IMF program and debt restructuring as a beacon of hope for economic recovery. The recent political developments and proactive measures taken by the government signal a commitment to stability and growth. As these efforts unfold, there is a growing sense of optimism that Sri Lanka can navigate its challenges and emerge stronger in the coming years.