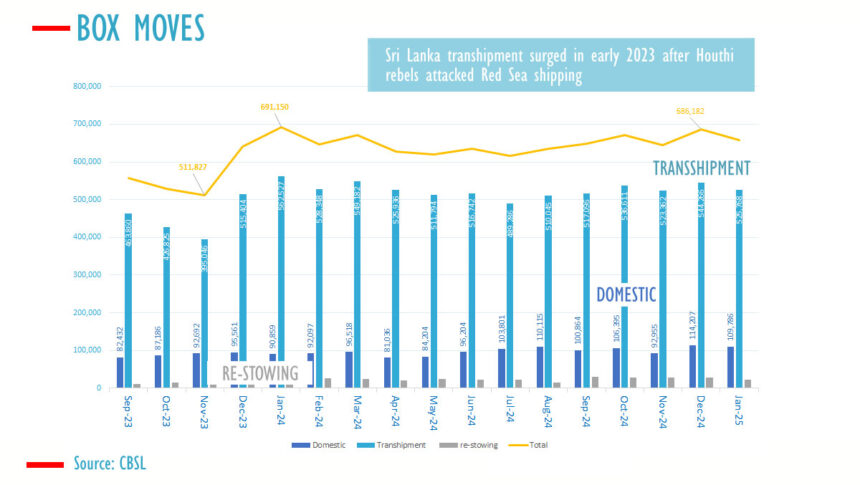

According to official data, Sri Lanka’s container transshipment volumes decreased 6.5 percent from the previous year to 525,768 twenty-foot equivalent units.

After Israel bombed the Gaza Strip, Houthi rebels began targeting Red Sea cargo, which led to a spike in transshipment at Sri Lanka’s Colombo Port in early 2023.

Transshipment volumes at Colombo ports, which were between 470,000 and 480,000 per month, increased to over 500,000 per month and reached 562,000 in January 2024.

According to figures released by the central bank, volumes were still above 500,000 in January 2025, despite a decline from 544,266 in December.

Whether domestic events decreased January’s transshipment quantities is unclear. In mid-January, Sri Lanka’s shipping minister said that a number of ships had avoided Colombo due to delays in port clearance caused by Sri Lankan customs.

Related Ships Avoiding Sri Lanka Due to Truck Traffic and Customs Delays: Minister

Conditions in the Suez Canal were supposed to return to normal by March, but new fighting has started.

India’s economic activity also affects Sri Lanka’s transshipment volumes. Transshipment flows from Sri Lanka have historically decreased whenever the Indian economy has slowed.

In addition to transshipping automobiles, Sri Lanka’s Hambantota port is only getting started in the container industry.

However, domestic volumes in Sri Lanka have been steadily increasing.

As the economy and private credit rebounded, container volumes, which had been about 80,000 in 2023 due to a decline in domestic credit, reached 100,000 in July 2024.

Sri Lanka has a high rate of saves, which makes it possible to accumulate foreign reserves and pay off debt, but additional imports are brought on by increased private savings investment.

When the central bank uses open market operations to re-finance private credit in order to increase inflation and potential output while simultaneously undermining monetary stability, unsustainable imports result.