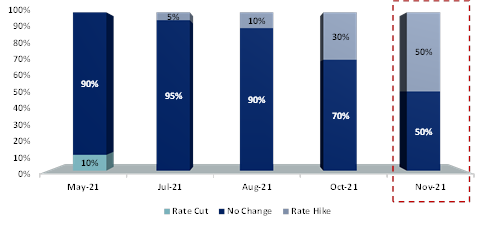

Ahead of the Monetary Policy Review Meeting of the Central Bank of Sri Lanka (CBSL), the First Capital Research predicted a 50% probability for a policy rate hike to prevent overheating of the economy amidst the given fiscal and monetary stimulus.

“We believe that CBSL may consider tightening the monetary policy rates in this policy review but given the concerns over economic growth, there is a considerable probability of 50% for CBSL to maintain its policy stance at current levels. With high frequent indicators improving in line with expectations, we have eliminated any probability of a rate cut. We expect a continued increase in probability for a rate hike in order to prevent overheating of the economy amidst the given fiscal and monetary stimulus,” First Capital in its Pre-Policy Analysis Report said.

It pointed out that Sovereign downgrades ensued from the depletion of foreign reserves, recovery in private credit growth and potential pressure on currency from the relaxation of import restrictions favours a policy tightening.

Moreover, Global central banks are moving towards a hawkish stance in curbing the surge in inflation across the world that reached beyond expectations as the low-interest rate regime has lost its effect which requires urgent countermeasures by monetary policy makers.

“Following the suit, Sri Lanka may also pursue an earlier policy normalization thereby unwinding the monetary stimulus provided throughout the pandemic days,” First Capital predicted.

Last month, Sri Lanka’s national inflation rose by over a record 8 percent and the food inflation has been growing in double digits while real wages are still recovering from the Pandemic.

CBSL either can choose to hike policy rates by 25bps or 50bps or hold policy rates steady, while a rate cut is off

the table due to the high debt repayment and the high domestic borrowing requirement, according to the report.