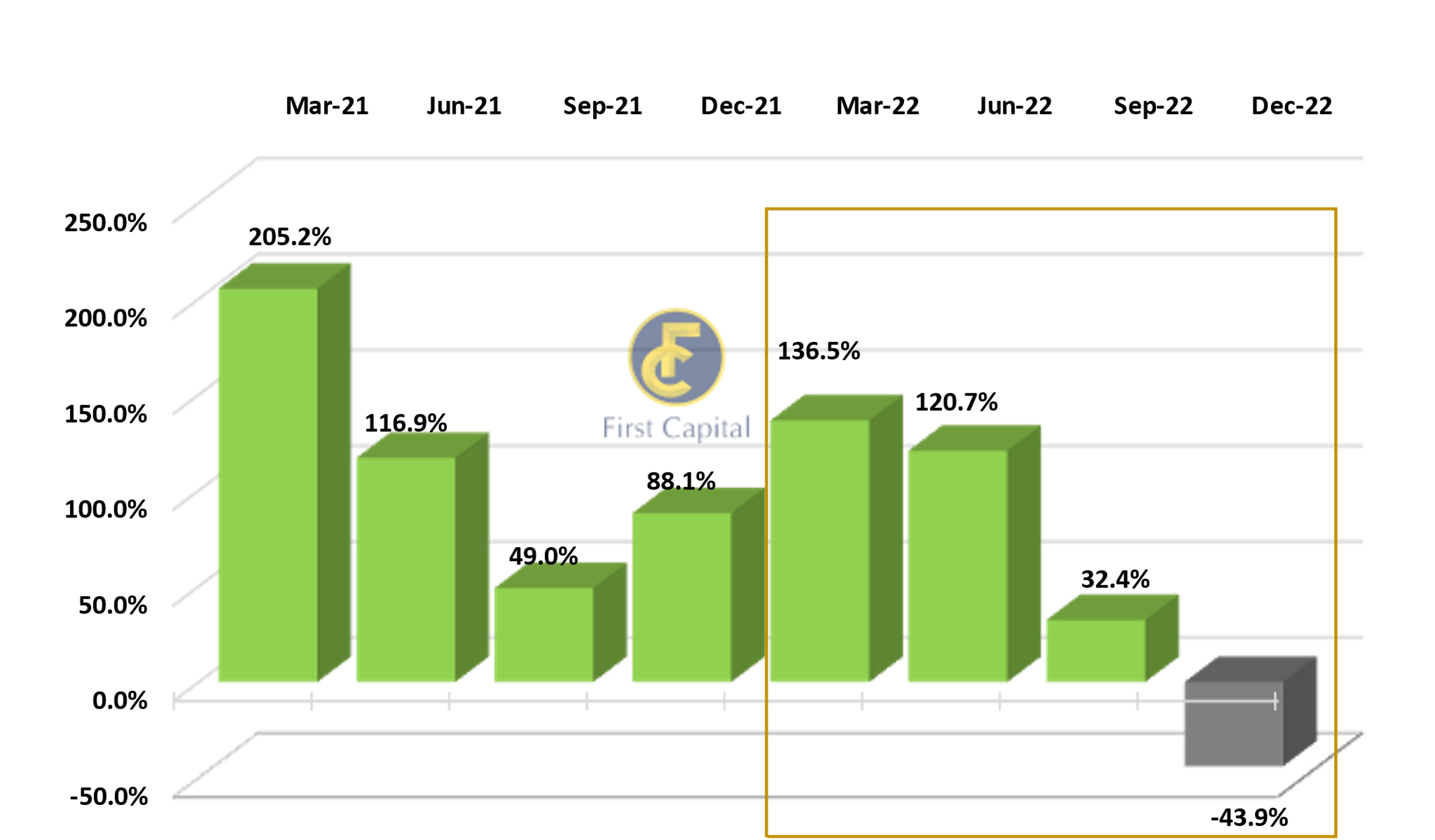

December (2022) quarter earnings declined by 43.9%YoY to Rs.96.4 billion for 281 listed companies on Colombo Stock Exchange (CSE) owing to sluggish performance primarily in the Capital Goods (-82.6%YoY), Transportation (-87.0%YoY), Telecommunications (-226.8%YoY) and Diversified Financials (-38.9%YoY) segments, according to First Capital Research (FCR).

However, upbeat quarterly performance was witnessed in the Energy (14,183.9%YoY), Banking (38.9%YoY), Food, Beverage & Tobacco (12.3%YoY), and Utilities (28.1%YoY) sectors.

Capital Goods saw an 82.6%YoY decline largely driven by the poor performance of Browns(-

3430.4%YoY) and Hayleys (-99.6%YoY) due to the significant rupee depreciation which caused a significant

increase in the cost of materials resulting in higher working capital requirements, increase in market rates,

foreign currency risk, and curtailed supplier credits by foreign suppliers due to the credit rating downgrade by international credit rating agencies following the economic instability of Sri Lanka.

The Transportation sector recorded an 87.0%YoY decline primarily led by Expolanka (-87.0%YoY) due to the reduction in operating volumes across both Air Freight & Ocean Freight products, led by the overall slowdown in global trade volumes impacted by high inventory levels, inflationary fears and the global energy crisis.

The Telecommunications sector also witnessed a downfall in net income by 226.8%YoY largely led by Dialog (-280.8%YoY) owing to the devaluation of the Rupee that escalated operational costs due to tariff revision of mobile, broadband, and payTV by 20%, 20%, and 25% respectively with effect from September 2022, in line with the approval granted by the Telecommunication Regulatory Commission of Sri Lanka.

On the other hand, Diversified Financials sector earnings dipped by 38.9%YoY mainly due to the losses made in LOLC (-41.8%YoY) as a result of a significant impairment adjustment for its fair value measurement of financial assets primarily in the financial services and manufacturing and trading segments. The lackluster performance in this sector during the quarter was also driven by an increase in corporate tax rates to 30% from 24% w.e.f. effective from October 2022.

The Energy sector recorded a growth of 14,183.9%YoY to LKR12.8Bn largely driven by the excellent performance of Lanka IOC which recorded an increase in earnings of 825.4%YoY to LKR8.2Bn aided by the fuel price revision formula, fall in global crude oil prices and an upward price revision of Auto Diesel by LKR 15.0 to LKR 430.0 during the month of November 2022.

The Banking sector witnessed a profit surge of 38.9%YoY to record LKR29.9Bn led by the Commercial Bank of Ceylon which saw a significant increase in net income by 68.2%YoY to LKR8.8Bn. This was assisted by the impact of the sharp depreciation of the Rupee on foreign currency loans and advances amidst a sharp decrease in credit to the private sector. The depreciation also resulted in an increase in interest-earning assets, higher foreign currency income, increased cost of living, and a rise in interest rates on Rupee deposits which resulted in the shift from low-cost funds to high-cost funds.

Food, Beverage & Tobacco sector earnings were supported by improved performance in Distilleries (193.3%YoY) and MelstaCorp (125.3%YoY) which were aided by high food inflation.