Fitch expects the new general special drawing rights (SDR) allocation to be approved by the IMF’s board of governors, likely in August. The move will raise foreign exchange reserves for IMF member states without creating new debt. Payout will come shortly after the approval and does not require conditions to be met.

Sri Lanka’s foreign exchnage reservers are expected to receive around $760 million boost from the proposed SDR allocation.

However, Fitch said that bulk of it will go to richer members since the allocation is in proportion to members’ IMF quotas.

The positive credit effects on low-income countries (LICs) of the IMF’s planned $650 billion allocations of special drawing rights (SDR) could be amplified by rich countries on-lending part of their new SDR, says Fitch Ratings as part of broader efforts to support LICs.

There is momentum behind proposals for richer countries to use their new SDR to support LICs, although the mechanisms are still under discussion. On-lending deals could be agreed bilaterally between individual countries and the IMF; the US, China and several European countries have voiced their support. France’s president has announced a target of USD100 billion in on-lending pledges by October. By comparison, African sovereigns will receive only USD33 billion under the general SDR allocation itself.

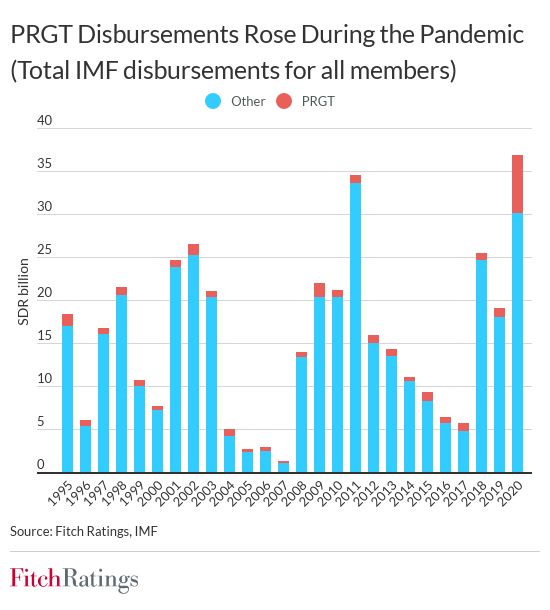

The main on-lending mechanism being considered is via the IMF’s Poverty Reduction and Growth Trust (PRGT), which supports concessional loans such as the emergency Rapid Credit Facility (RCF) and the regular Extended Credit Facility (ECF). Other mechanisms, including those via the World Bank and other multilateral development banks (MDBs), are also under debate but details are still vague. These could focus more on project-related financing – for instance for Covid-19 vaccination or climate-related projects.

The IMF decided in March to increase access limits to its concessional loans, temporarily raising annual disbursements caps under the PRGT to 245% of a country’s quota, from a 150% limit in place since July 2020 and 100% prevailing before that. At this new ceiling, annual disbursements could be up to 3%-4% of recipients’ GDP, though we expect most disbursements to be well below this level.

Most IMF loans to LICs last year were under the RCF, which did not require conditionality, but the IMF has made clear that it expects further lending to fall increasingly under regular programmes such as the ECF, which have conditionality. The increase in access limits, potentially backed by large-scale on-lending of SDR to boost the funding available, could incentivise LICs to negotiate IMF programmes. Nonetheless, conditionality may impede some from agreeing IMF deals, particularly where authorities are committed to policies the IMF considers problematic.

A large number of regular programmes is likely to be concluded over the next year. In Africa, for example, the IMF has this year already agreed a programme with Kenya (B+/Negative), and reached staff level agreements with Senegal and the Democratic Republic of the Congo (both unrated), Cameroon (B/Stable) and Uganda (B+/Negative). The authorities have also acknowledged negotiations with the IMF in Zambia (RD).

Such programmes would ease immediate financing pressures and provide policy anchors. We believe fiscal consolidation will be less of an immediate priority in these programmes, compared with the pre-pandemic era, but still expect programmes to encourage medium-term debt sustainability, structural reforms and revenue mobilisation.

The prospect of increased IMF financing could incentivise a small number of countries at high risk of debt distress to restructure under the G20 Common Framework. While the Common Framework directly concerns bilateral debt, the requirement for comparability of treatment could lead to restructuring of debt to private-sector creditors. Consequently, we believe a decision to seek debt restructuring under the Framework is unlikely to be compatible with a rating higher than ‘CCC’.