Sri Lanka has lost a large chunk of its tax base due to significant changes in its tax system made in 2020 including the increase in VAT registration threshold on business and replacement of the PAYE tax system, according to insights from Publicfinance.lk.

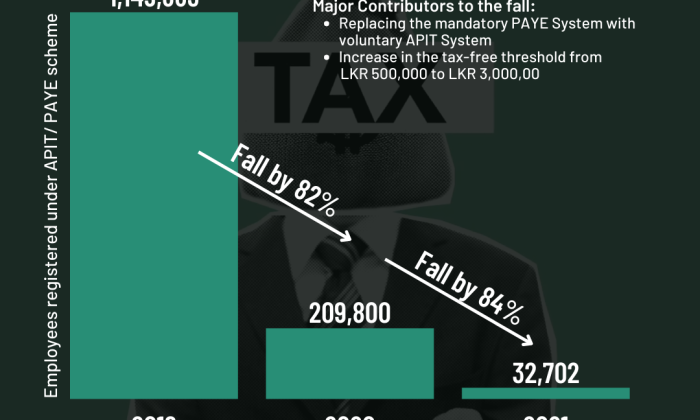

Accordingly, the number of employees registered to pay monthly tax on their incomes reduced by 97% from 2019 to 2022, this was mainly due to the replacement of the mandatory Pay-As-You-Earn (PAYE) tax system with an optional Advanced Personal Income Tax (APIT) system and the increase in the tax-free threshold by 6 times. There was also a change in the system to pay taxes on interest income. It was initially done via withholding tax, which was replaced with Advanced Income Tax for 2020, this led to a reduction in agents registered to pay taxes on interest income by 63% for the same time period. Lastly, by increasing the VAT registration threshold from Rs.12 million per annum to Rs. 300 million per annum, the number of companies registered for VAT fell by 69% from 2019 to 2022.

According to Verite Research publication “Restoring Efficient Tax Collection Methods: Withholding Tax and Pay-As-You-Earn”, by reinstating the mandatory Pay-As-You-Earn (PAYE) tax and the Withholding Tax at 10% as a prepayment on interest, fees and other incomes, would help Sri Lanka regain its lost tax base and gain an additional revenue of Rs. 184 billion in 2023.