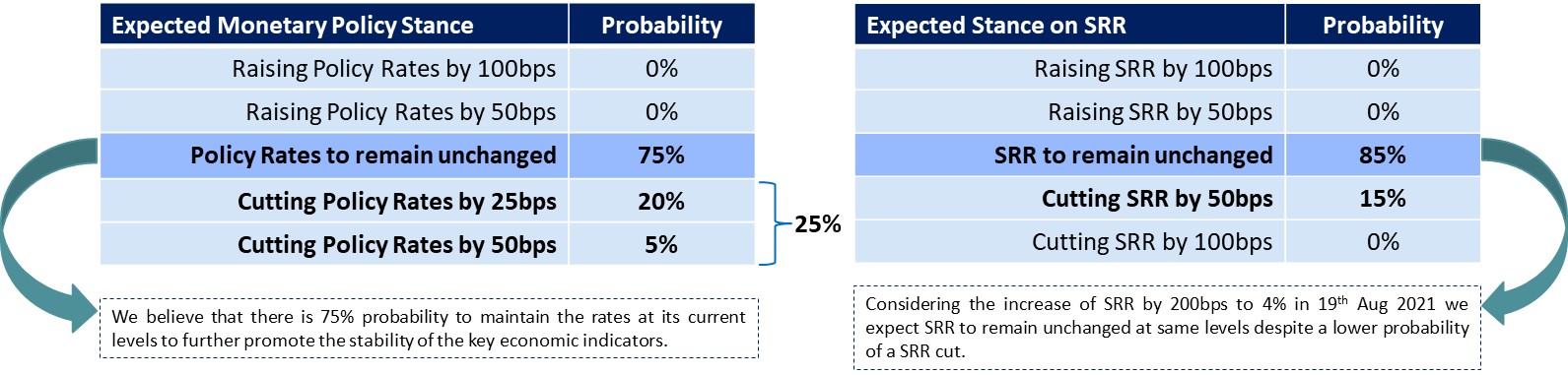

First Capital Research (FCR) weighed in on a 75 percent probability to maintain the rates while also assigning a lower probability of 25 percent towards a monetary relaxation.

“We believe that CBSL may consider maintaining the monetary policy rates at its current levels in the upcoming policy review meeting allowing a soft landing from its hawkish to dovish stance. However, given the necessity to provide monetary stimulus to prevent further weakening of the economy and

the notable improvement in the majority of the key economic indicators, we have assigned a lower probability for relaxation in the monetary policy to alleviate the overreacted interest rates in the tighter monetary environment,” FCR said in its pre-policy analysis report/

However, FCR noted that considering the positive outlook over the next 6-12 months.

“We expect a complete normalization of the economy with the country being able to secure necessary financing from IMF and other multilateral creditors while regaining its access to the global capital market. Thus, the complete stabilization of economic indicators may give rise to a possibility of sizeable rate cuts towards 1Q2023 with a significant probability to fast track the revival of the economy,” it added.