The Colombo-Based, First Capital Research expects the Central Bank to hold its policy rate steady at the upcoming monetary policy review amidst sweeping measures to insulate the economy.

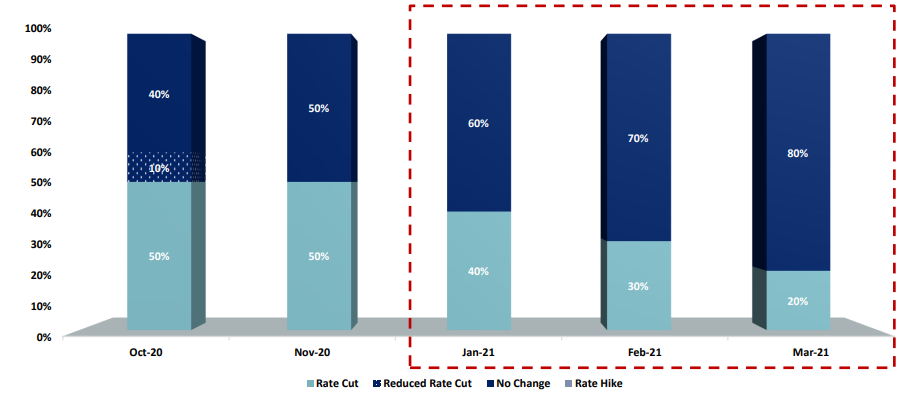

“We believe that there is a 60% probability to hold rates due to the considerable improvement in high-frequency indicators and with fiscal and monetary measures implemented so far. However, there is a 20% probability each for 25bps and 50bps rate cut to support economic growth,” FIrst Capital said in its Pre-Policy report today.

It pointed out that excess liquidity prevailing in the domestic market, gradual rebound in private credit and rock Bottom Interest Rates would favour the Central Bank to hold its policy rates steady.

However, it was noted that growth-oriented endeavours and access to less expensive domestic funding backs further easing of the policy rates.

“We expect only a 40 percent probability for a rate cut at the upcoming meeting,” it stated.