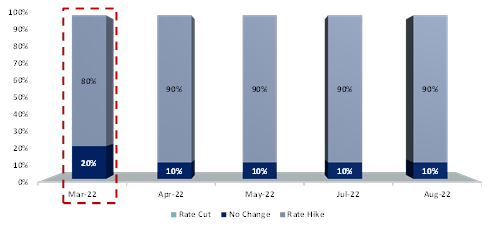

Colombo-based independent research house, First Capital Research predicted an 80 percent probability for a policy rate hike at the upcoming Monetary Policy Review Meeting of the Central Bank of Sri Lanka (CBSL) to be held on the 3rd of this month.

“As per our view, CBSL either can choose to hike policy rates by 50bps, 100bps or 200bps or hold policy rates steady, while a rate cut is off the table due to the continuous depletion of foreign assets and high debt repayment requirement. We believe that there is an 80% probability for a rate hike due to the remedial actions required in achieving macroeconomic stability,” the Research House said in the Pre-Policy Analysis report released yesterday.

However, it acknowledged a 20% probability to maintain the policy rates at their current level in order to further improve the high-frequency indicators.

“We believe that CBSL may consider further tightening the monetary policy rates in this policy review but given the concerns over economic growth, there is a probability of 20% for CBSL to maintain its policy stance at current levels. With high frequent indicators improving in line with expectations, we have eliminated any probability of a rate cut. We expect a continued increase in probability for a rate hike in order to prevent overheating of the economy amidst the given fiscal and monetary stimulus,” it said.