The Monetary Board of the Central Bank of Sri Lanka (CBSL) is widely expected to hold policy rates steady in the upcoming Policy Review meeting, according to First Capital Research (FCR).

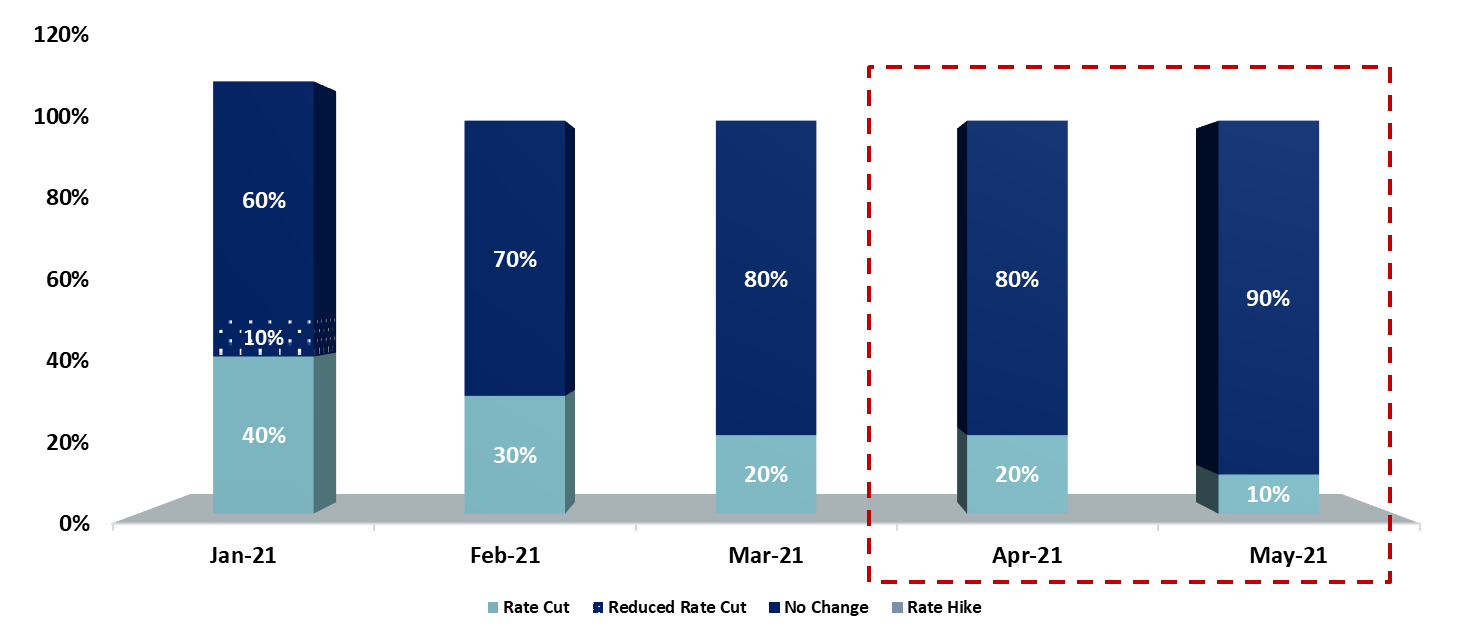

“As per our view, CBSL either can choose to hold policy rates steady or cut by 25bps or 50bps while a hike is off the table due to the lackluster economic growth. We believe that there is an 80% probability to hold rates due to the considerable improvement in high-frequency indicators and with fiscal and monetary measures implemented so far. However, there is a 10% probability each for 25bps and 50bps rate cut to support economic growth,” FCR stated in its latest Pre Policy Analysis Report.

The report highlighted that improving economic indicators backed up the COVID-19 vaccination program, surplus liquidity in the system and private sector credit growth witnessed recently argues against a possible rate cut in the upcoming policy review.

In the meantime, FCR acknowledged that the government’s insistence on the need for a higher growth trajectory and rise in Treasury yields with auctions getting undersubscribed consecutively may persuade the CBSL to consider a possible rate cut in the upcoming policy review meeting.