A new report launched today by the World Economic Forum reveals that the Semiconductors, Electronics and Pharmaceuticals sectors are leading the way in the digital transformation of manufacturing. The Manufacturing Transformation Insights Report2022 offers new insights and findings emerging from the new Global Smart Industry Readiness Index (SIRI) initiative, which aims to build the world’s largest datasets and benchmarks on the state of manufacturing globally.

In collaboration with the Singapore Economic Development Board (EDB), the report draws on data from close to 600 manufacturing companies in 30 countries that underwent the Official SIRI Assessment (OSA): a two-day independent review of a factory or plant. The report outlines the current state of industrial transformation across different sectors, and presents detailed case studies on how different stakeholders – ranging from manufacturers to industry associations and governments – are actively leveraging the SIRI programme to accelerate their digital transformation journeys.

Key findings:

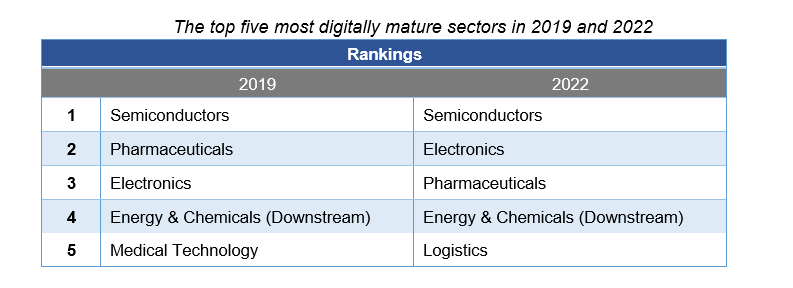

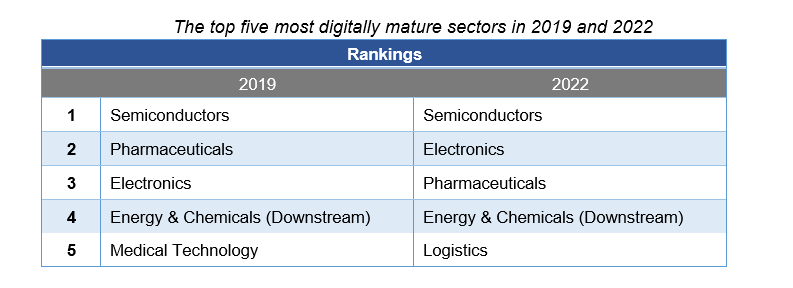

1. Semiconductors, Electronics and Pharmaceuticals lead the 2022 Maturity rankings, with Logistics making gains

Despite their frontrunning positions, these top three industries are not shielded from present-day challenges like the ongoing value-chain disruptions, global chip shortage and industrial decarbonization. These developments will reshape the global manufacturing landscape and companies from these leading sectors – as long-standing pioneers of innovation and adopters of new concepts and technologies – must confront these topics proactively to redefine them into opportunities for all.

2. A high level of diversity exists across various industry sectors; more tailored approaches are required to better support industry transformation

Governments and solution providers tend to apply “one-size-fits-all” approaches in supporting manufacturers on their digitalization journeys, such as state-level subsidies for the adoption of new automation equipment or industry-led forums that study use cases of global companies. The impact and efficacy of such blanket interventions has been limited.

3. The most digitally mature companies are seeking to integrate their already digitized processes and systems, while the average manufacturer is still looking to digitize existing operational processes

New digital and hardware technologies, coupled with integrative design principles, have opened a world of possibilities for manufacturers. Over the past two years, most manufacturers have taken first steps towards digitalization in response to pandemic-related challenges. Companies which have started earlier are now progressing to the next level of integrating their digitized processes.

4. Top companies have focused significantly on Connectivity to enable greater integration and insights

In today’s digital economy, connectivity is fast joining automation as a key driver of success. Top companies acknowledge the importance of Connectivity. Many have already established interoperable and secure networks within their production sites, where equipment, machinery and computer-based systems can interact and exchange information with few restrictions.

5. Manufacturers should put more emphasis in refreshing and broadening their strategies for digitalization and workforce retraining

With the advent of digitalization, job scopes and work arrangements are evolving rapidly. As manufacturers formalize their digitalization strategies to upgrade their manufacturing and enterprise processes, there is a need to also re-examine the way they organize their workforce and workspaces as remote working becomes more prevalent in the digital era.

6. Productivity- and quality-linked KPIs are key focus areas of MNCs and SMEs, but flexibility and speed are fast-emerging areas of priority

Exponential demand growth, changing consumer patterns and chronic supply-chain disruptions during the pandemic have prompted some groups of companies to shift their focus to flexibility and speed-related KPIs to strengthen adaptability and resiliency. Initiatives that demonstrate such shifts include efforts by manufacturers to reorganize their supply chains based on regional geographical markets, practising dual/triple sourcing and adopting hybrid inventory management models that include elements of both “just-in-time” and “just-in-case” strategies.

7. Data confirms SME-dominated sectors are less mature than MNC-dominated sectors

The bottom five-ranked industries are dominated by SMEs. While this might not surprise many, the SIRI insights validate this long-standing narrative. Through the COVID-19 pandemic, SMEs continue to face intense short-term business pressures, limited expertise and tight resources, all of which hinder the adoption of new advanced manufacturing processes and technologies.

8. MNCs and companies ahead of the maturity curve are more likely to plan for the long term Companies that are larger or further ahead in the digitalization journey tend to think more long term than smaller companies or those still early in the journey. In time, this will widen the maturity divide between those that are ahead and resource-rich and those that are not.

To support the international scale-up of SIRI, a new non-governmental, not-for-profit organization – International Centre for Industrial Transformation (INCIT) – has also been established. As a neutral, independent entity, INCIT will work with both the public and private sector manufacturing-related organizations to catalyze and support industrial transformation across geographies and industries.