The overall selling prices of houses had increased by 22.53% and apartments by 17.68% in Q4 2021 when compared to Q4 of 2020, indicating an all-time high price, according to the latest release of 2021 Q4 data of LankaPropertyWeb’s House Price Index (HPI), which is based on the asking prices of its listings. Residential land prices in the Western province (except for Colombo) however had reduced by 14.76% from Q4 of 2020. While lands in the Central province and Southern province saw positive growths of 22.6% and 19.4% respectively. With a section of the Colombo – Kandy expressway opening to the public in November, the demand for residential lands in this area is expected to improve further.

The value of lands for sale in Colombo city saw a minor increase of 3.5% from Q4 of 2021 to Q4 2020. While the selling prices of lands in the Northern Province recorded a significant increase of 45.1% when compared to Q4 2020.

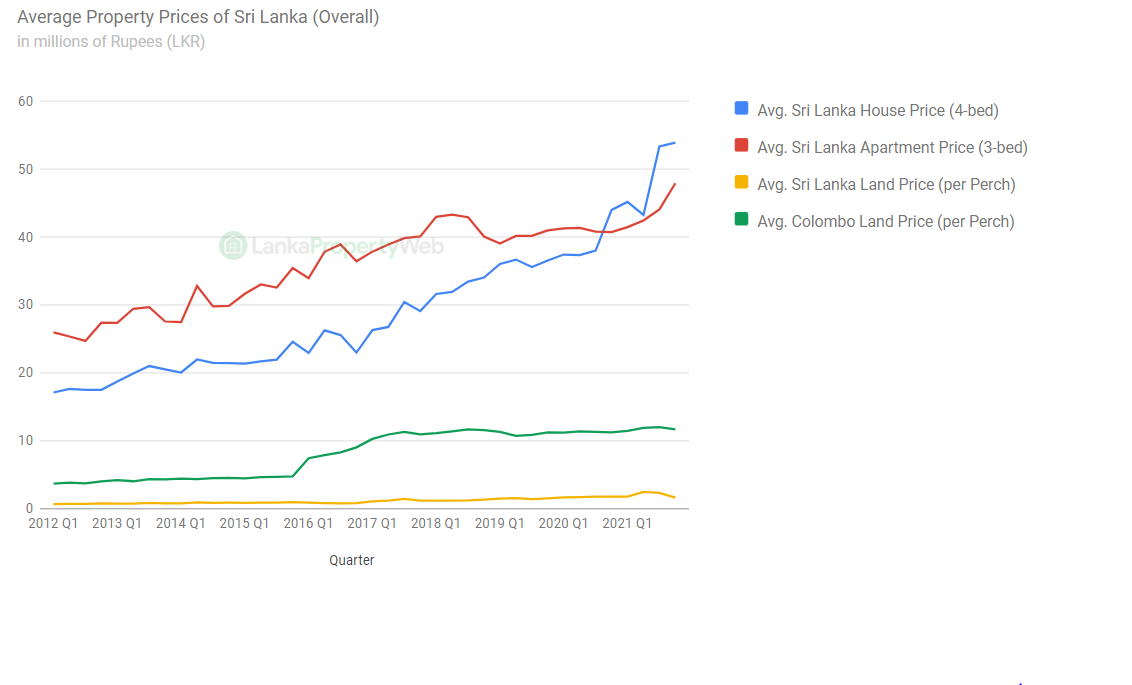

The House Price Index further revealed that the prices of houses and apartments are at their highest since the index was introduced in 2012. Between Q4 of 2021 and 2020, the apartment values increased by 17.68% with the selling price of a 3 bedroom unit in Colombo rising by 24.11%. This indicates the growing trend of vertical living in urban areas. In addition to this, with the increasing construction costs, this time proves to be favourable for developers looking to sell out units and homebuyers searching for fruitful housing options.

From the beginning of 2021, the prices of construction materials such as electric cables, PVC pipes and steel have continuously increased while a shortage in cement and a price hike of it was witnessed particularly towards the end of 2021. These have discouraged many people from the thought of building their own home and in turn positively impacted the demand for existing apartments that has seen consistent growth over the past months.

At present, the prices of apartments have increased by 17.68% which is an average between LKR 3 – 5 Mn and the costs of constructing a house has risen by 20% – 30% with the rising raw material prices and labour. Therefore, by purchasing property now rather than later, investors are able to generate higher returns as the prices are unlikely to reduce in future and are expected to keep increasing.

Individuals searching for investment sources to invest or to hedge their disposable earnings in— given the economic changes such as rising inflation and Rupee depreciation, are also considering investing in luxury to mid-range apartments that have proven to be resourceful assets during this time.

By conducting a survey with the realtors listed on lankapropertyweb.com the LankaPropertyWeb Research also learned that the need for such investments have been particularly strong during this period with demand increasing for apartments or houses over lands.