Sri Lanka along with Egypt, Romania, Turkey are vulnerable to an exchange rate crisis in the next 12 months, according to Nomura’s early warning indicator of exchange rate crises, Damocles.

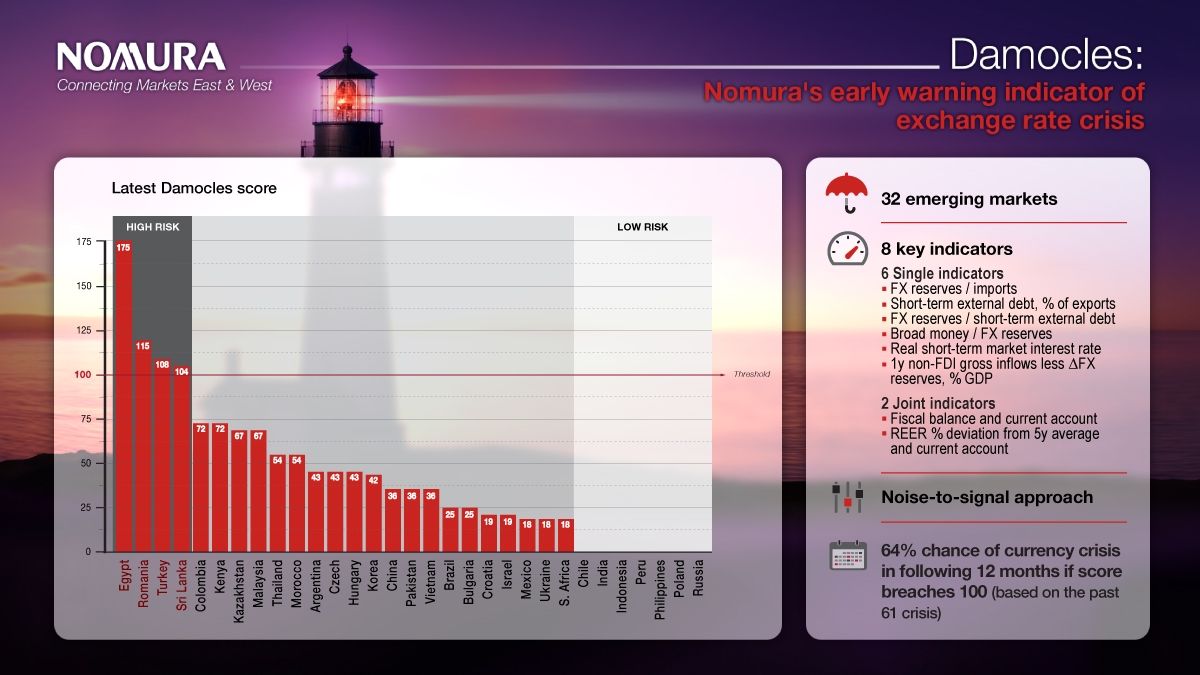

Damocles, which is Nomura’s early warning model of Emerging Market (EM) exchange rate crises, is considered to be a useful tool to warn of possible triggers and provide a wake-up call. Whenever the Damocles index exceeds 100, it is interpreted as a warning that the country is vulnerable to an exchange rate crisis in the next 12 months. In the latest update, Nomura revealed that Egypt, Romania, Turkey, and Sri Lanka are currently at risk, all with scores over 100.

Damocles summarizes a lot of disparate information into a single summary measure. Its objectivity lets the data speak without being clouded by cognitive biases to assess how vulnerable a country is. Setting a threshold of 100, Damocles correctly signaled 64% of the past 61 crises in our sample of 32 countries, with data going back 25 years. A Damocles reading above 150, as it is now for Egypt, is a starker warning that an exchange rate crisis could erupt at any time.

“The Covid-19 pandemic has given rise to new sources of emerging markets (EM) vulnerabilities, including chronically weak economic recoveries. It has also brought about sharply higher inflation where even recent policy rate hikes have not been able to keep real interest rates up in most EM. Looking ahead, the prospect of the Fed normalizing monetary policy amid China’s deepening economic downturn is not a particularly good combination for EM, and this is only exacerbated by three other vulnerabilities lurking in the shadows: a growing EM bank-sovereign debt nexus, the danger of ballooning fiscal deficits leaking into sizable current account deficits, and a potential EM food crisis,” Nomura said.

Many believe that EM is in a more resilient position now than on the eve of the 2013 taper tantrum. Back then, the so-called fragile five – Brazil, India, Indonesia, South Africa, and Turkey – had large current account deficits, low FX reserves and had attracted a wall of hot money inflows that could leave in a flash. Eight years on, the current account deficits are mostly smaller or are in surplus, and FX reserves have been built up.

But the primary reason for the absence of EM currency crises during the pandemic was the slashing of interest rates by major central banks and the sheer size of their quantitative easing programs as seen in Sri Lanka. This helped avoid a sustained exodus of capital from EM and has also blurred investors’ perceived trade-off between EM risk and return.