The 35-year-old Colombo Stock Exchange (CSE) set eyes to take a quantum leap – towards a much more comprehensive and multi-product securities exchange before 2025 in catching up with lost years.

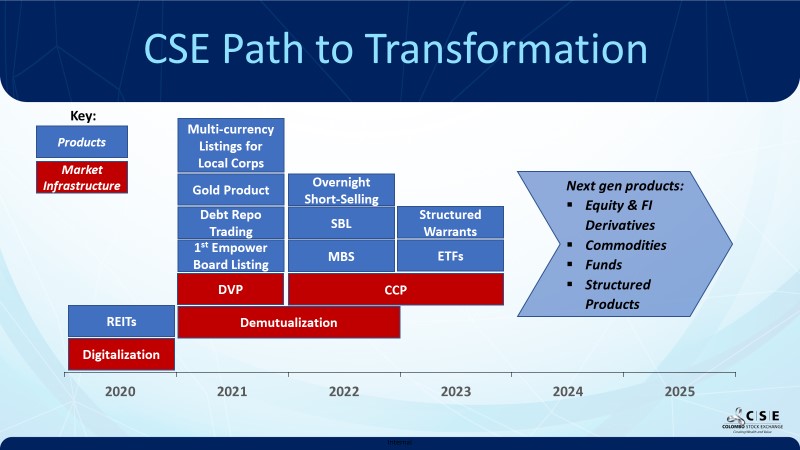

Under its ongoing ambitious transformation program began in 2020, the CSE set timelines to move into the Delivery versus payment settlement process shortly and to complete the setting up of a central counterparty clearing house before 2024. These critical market infrastructures will enable the CSE to introduce a range of new products from Equity and fixed income products to derivatives products.

The CSE is expecting to complete its transformation towards a comprehensive and multi-product securities exchange by 2025 with the introduction of so-called ‘Next-gen products’ consisting of Equity and fixed income products, derivatives, commodities, Funds, and Structured Products.

The demutualization process of the CSE is scheduled for completion before 2023, which would also be anticipated to support the ambitious transformation.

“This market in a regional or global context has been somewhat more limited in its number and diversity of product offerings. Why it is the right time for you all to engage with the CSE, is the ambitious transformation program currently underway at the CSE which is expected to move it significantly – and in our aspiration, take a quantum leap – towards a much more comprehensive and multi-product securities exchange,” the CSE, Chairman, Dumith Fernando said in his keynote speech at Sri Lanka Investor Forum yestreday.

For twenty years starting from 1998, the CSE was unable to introduce any new product to the investors despite being regarded to be one of the first exchanges globally to adopt automated clearing house, back in 1991.

While the trading activities were dominated by local investors in recent year, Fernando highlighted that the liqudiity levels of stocks increased considerably.

“While average daily trading turnover on the CSE stood around the US$4-5mil/day, 3 or 4 years ago, last year this was over US$10mil/day and this year that has doubled to US$23mil/day. Interestingly, the number of stocks trading large volumes daily as also risen. In the years before 2020, between 8 and 14 companies traded over US$100,000/day on the CSE. This year we have seen that number go up to 37 stocks. This provides many more investment options on the CSE especially to foreign investors,” he added.